Read time: Under 4 minutes

Hello, Market Reader’s

Investor spirits are riding high as the U.S.-China 90‑day tariff truce breathes fresh life into markets, steering them away from a sharp spike in duties and opening the door for calmer trade talks. Stocks from Tokyo to Sydney are rallying Japanese indices hit record highs, and Australian equities are trading near peaks after a rate cut. But anticipation is the name of the game now eyes are locked on U.S. inflation and UK labor data due today, which could tilt the scales for the next chapter in monetary policy.

Today’s Global Menu

Focal Point

World Markets

Frontier News

Crypto World

FOCAL POINT

Tariff Tension Paused: 🇺🇸US-China🇨🇳 Trade Truce Extended

In a move that sets the stage for restrained diplomacy over confrontation, the U.S. and China have agreed to extend their tariff truce by 90 days, averting what could have been crippling duty hikes up to 145% on American imports and 125% on Chinese goods due to take effect on August 12. Under the extension, current tariffs stay at 30% on Chinese imports and 10% on U.S. goods, offering breathing room for retail inventories ahead of the holiday rush.

The extension comes as both nations conduct talks in places like Geneva and Stockholm, aiming to prevent the chokehold that triple-digit tariffs would impose symbolically and economically.

Markets welcomed the news: Asian stock markets climbed, Japanese indices soared, and global sentiment improved amid hopes that this truce could pave the way for a Trump–Xi summit this fall.

Meanwhile, oil prices ticked upward, buoyed by reduced trade tension and investor optimism.

Stay Ahead of the Market

Markets move fast. Reading this makes you faster.

Every weekday, you’ll get a 5-minute Elite Trade Club newsletter covering the top stories, market-moving headlines, and the hottest stocks — delivered before the opening bell.

Whether you’re a casual trader or serious investor, it’s everything you need to know before making your next move. Join 160k+ other investors who get their market news the smart and simple way.

WORLD MARKETS

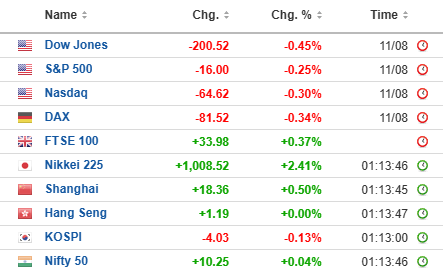

🌊 Tremor: Markets took a slight step back as U.S. stocks dipped ahead of key inflation data S&P 500 down 0.3%, Dow Jones off 0.5%, and Nasdaq off 0.3%. Investors are holding their breath, wondering if July’s CPI will tip the scales toward near-term Fed action.

🚀 Skyrocket: Asia’s equities are on fire Japan’s Nikkei rallied to a record high, and Australia’s ASX followed suit, as optimism surged around the extended U.S.–China tariff truce and expectations of further rate cuts. A potent mix of calm trade winds and easing policy is fueling a regional rally.

📈 Pulse: Behind the scenes, Australia’s stock market is racing ahead, buoyed by strong corporate earnings and RBA rate cut hopes. The ASX 200 is now up nearly 8% year-to-date, but Goldman Sachs flags stretched valuations.

FRONTIER NEWS

🔥 Heatwave: U.S. inflation’s cooling down… or is it? July’s CPI is expected to show a modest 0.2% month-over-month increase (2.8% year-over-year), signaling mounting pressures from tariffs on items like furniture, toys, and apparel and raising fresh doubts about data quality at the Bureau of Labor Statistics.

⏬ Slowdown Australia’s central bank just downgraded its growth outlook and trimmed productivity forecasts clearly putting living standards and incomes in the slow lane. Yet, with inflation still treading the target band and unemployment stable, policymakers are keeping the door open to more rate cuts.

⚖ Firestorm: Elon Musk is firing back, publicly accusing Apple of rigging its App Store rankings in favor of OpenAI’s ChatGPT and announcing immediate legal proceedings from xAI. It’s a high-voltage showdown in the race for AI dominance on mobile platforms.

💰 Windfall: The Congressional Budget Office just raised the bar Trump’s “One Big Beautiful Bill” now benefits the top 10% to the tune of $13,600 per year, while the lowest 10% face a $1,200 loss, largely due to cuts in Medicaid and SNAP.

CRYPTO WORLD

Ethereum’s ETF Boom: $1B Inflows as BlackRock Leads the Charge

Today’s crypto headline sparkles with momentum: U.S. spot Ethereum ETFs just recorded a staggering $1.02 billion in net inflows, marking a historic high since their launch. Leading the surge, BlackRock’s ETHA drew $640.7 million, followed by Fidelity’s FETH with $276.9 million, while smaller players like Bitwise, Grayscale, and VanEck captured modest shares demonstrating institutional confidence across the board.

This isn’t a one-off spike. It dovetails with recent trends where Ether ETFs have seen explosive growth, including days with $727 million in inflows fueling questions about whether Ethereum is on the cusp of ousting Bitcoin from the top institutional appetite charts.

Why does this matter? It signals a shifting tide: Ethereum is shedding its “altcoin” label, emerging as a frontrunner in the institutional crypto narrative. As investors pile in, the stage is set for deeper regulatory clarity, broader product innovation (like staking-enabled ETFs), and heightened mainstream legitimacy for crypto.

How A Small Crypto Investment Could Fund Your Retirement

Most people think you need thousands to profit from crypto.

But this free book exposes how even small investments could transform into life-changing wealth using 3 specific strategies.

As markets recover, this may be your last chance to get positioned before prices potentially soar to unprecedented levels.

Your Opinion Matters!

Got more feedback or just want to get in touch? Reply to this email and we’ll get back to you.

Thanks for reading.

Until tomorrow!

Hanoomaan Global Markets team

Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy.