Read time: Under 4 minutes

Hello, Market Reader’s

Asia-Pacific markets danced a mixed tune today as a tentative Trump - China rare-earths deal collided with Thailand’s surprise CPI rebound. The Nikkei and Hang Seng dipped, while South Korea’s Kospi climbed reflecting investor tug-of-war between trade optimism and inflation jitters. Thailand’s inflation uptick hints at looming rate cuts, stirring sectoral shifts.

Today’s Global Menu

Focal Point

World Markets

Frontier News

Crypto World

Focal Point

🌏 Asia-Pacific Opens to Mixed Signals Amid Rare-Earths Breakthrough & Inflation Jitters

A striking image of China's industrial sprawl offers the perfect metaphor for today’s Asia-Pacific markets: complex, layered, and shifting fast.

On one hand, a breakthrough between President Trump and Xi Jinping on rare-earth mineral exports has lifted hopes across trade-sensitive sectors. These critical elements are the lifeblood of everything from

EVs to semiconductors and the reopening of U.S.-China trade channels could mark the first true thaw in a years-long standoff.

On the other hand, Thailand’s surprise inflation surge is nudging investors to rethink monetary policy expectations across the region. With energy and food prices inching upward again, rate cut optimism is being recalibrated.

Market moves reflected this duality:

Nikkei and Hang Seng edged lower, signaling caution

Kospi gained modestly, bolstered by tech optimism

World Markets

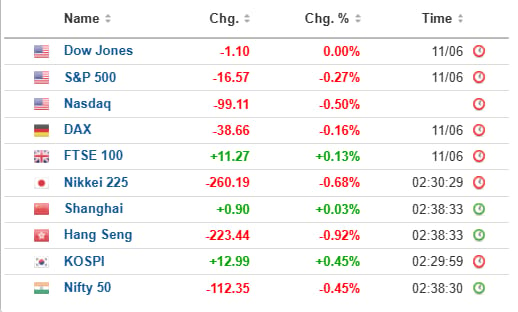

⚖️ Tension: Global markets are treading water today, with Asian stocks mixed and bond yields slipping as investors brace for the Fed’s next move. The tension feels like the calm before a financial thunderstorm.

⚠️ Shock: Shares of Indian fintech giant Paytm plunged after government officials flagged “compliance concerns.” It’s a stark reminder that in India’s digital finance gold rush, the rules of the game can shift overnight.

🚀 Surge: Tesla stock revved up nearly 6% after Elon Musk reportedly met with Donald Trump and teased an August launch for the long-awaited robotaxi. Whether political alignment or futuristic mobility, Musk is once again writing tomorrow’s headlines today.

🛑 Pause: India’s Nifty and Sensex opened flat on Thursday, mirroring global hesitation ahead of critical inflation data. For now, the mood is cautious like tiptoeing through a minefield of macroeconomic signals.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

FRONTIER NEWS

1. Priced: U.S. consumer prices rose a modest 0.1% in May, lifting headline CPI to 2.4% just below expectations. Core inflation remains steady, calming markets and reigniting whispers of a possible Fed rate cut later this year.

2. Scarceness: America’s debt ceiling stalemate has shrunk the Treasury-bill pool by roughly $375 billion since January. With yields tumbling and money-market funds battling for cash, the tension ramps up as the “X date” looms in mid‑August.

3. Fortify: Gold’s safe-haven shine continues, climbing on renewed Middle East tensions and tariff uncertainties. The yellow metal is outperforming as investors ladder into risk-off assets painting a bold statement about global geopolitical unease.

4. Leverage: China has slapped a six-month cap on rare-earth export licenses to U.S. manufacturers part of a tentative deal tied to easing U.S. tech export restrictions. This pause provides temporary relief but keeps Beijing’s strategic edge intact.

Crypto World

🚀 Explode: A meme coin inspired by GameStop surged over 500% after the retailer unveiled a $1.75 billion convertible note plan fueling speculation it’s geared for more Bitcoin accumulation. Retail traders are buzzing over GME doubling down on its evolving crypto-treasure strategy.

📈 Teeter: Ethereum flirted with the upper edge of its ascending channel, currently testing ~$2,820 resistance after weeks of consolidation. Breaking upward could catapult it toward the coveted $3,000 zone possibly heralding the return of full-blown altseason.

💰 Fortunate: If you’d tossed $100 into Trump’s crypto picks in January, you’d now be sitting on handsome returns thanks to surging investor enthusiasm around politically charged tokens. This shows how narrative-driven trades can spin quick wealth or wild swings.

🔥 Boom: SunCrypto just launched INR-denominated crypto futures and is waiving fees for the first month. It’s a bold move aimed at luring Indian traders into derivatives.

Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy.