Read time: Under 4 minutes

Hello, Market Reader’s

Banks are gearing up for a profit revival as Q2 earnings are expected to ride a wave of volatile capital markets and ramped-up trading a direct payoff from swollen tariff volatility fueling equity activity.

This earnings season kicks off with giants like JPMorgan, Citigroup, Wells Fargo and Goldman Sachs rolling out numbers, spotlighting whether investment banking and trading desks can sustain upbeat momentum.

Investors are on the edge of their seats: strong trading and capital markets performance could unlock another leg higher in bank stocks, but with share prices already rallying, even a modest miss could sting.

Today’s Global Menu

Focal Point

World Markets

Frontier News

Crypto World

Focal Point

📉 A Bear Steepener Could Shock the Markets Are You Ready?

A rare but potent shift might be forming in the bond market: the bear steepener. Unlike the more common bull steepener, this one occurs when long-term bond yields rise faster than short-term ones a signal that inflation concerns are flaring and investor confidence is cracking.

🔍 What’s triggering this?

Rising long-term rates hint at doubts over the Fed’s inflation control

A slowing economy paired with sticky inflation is making investors jittery

Debt refinancing risks for corporates and governments are rising fast

📉 Why this matters:

If the bear steepener accelerates, it could rattle equities, crush long-duration assets, and tighten financial conditions across sectors especially real estate and tech.

⚠️ Implication for investors and operators:

Reassess duration risk across your portfolio

Watch financial sector profitability steepening curves often benefit banks

Keep a close eye on policy shifts from the Fed and global central banks

In markets, surprises don’t whisper they roar. A bear steepener is one such roar that could redefine capital flows this quarter.

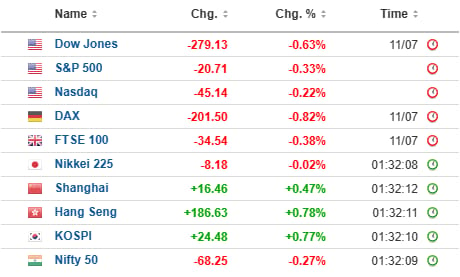

World Markets

I Asia markets tread carefully amid global uncertainty

Asian indices opened mixed on Monday: Japan’s Nikkei edged down, Australia’s ASX 200 held firm, South Korea’s Kospi eased after profit‑taking, while China’s CSI 300 and India’s Sensex dipped over 0.3%, reflecting concerns over U.S. tariff escalation and pending inflation data . Indian tech and financial stocks led the slide, though domestic mid- and small-caps showed relative resilience. With U.S. futures in the red, investors are eyeing home‑grown earnings to guide sentiment.

II. U.S. earnings season and inflation hold global sway

This week marks the official kick-off of Q2 earnings, with heavyweights like JPMorgan, Goldman Sachs, Wells Fargo, Netflix, TSMC, J&J, and PepsiCo set to report . June’s CPI release is also due, and economists expect a 2.7% year-over-year rise potentially giving fresh ammunition to Fed policy hawks and shaping investor appetite. The tug-of-war between earnings strength and inflation pressures is set to define market direction.

III. Netflix in the spotlight but what’s priced in?

Netflix is expected to report Q2 revenue growth of around 12%, drawing analysts’ attention for signs of sustainable subscriber momentum. As a bellwether for consumer streaming demand, its results could reverberate across tech stocks. Will the market cheers or seize the pause button? The verdict is due midweek.

FRONTIER NEWS

1. U.S.–EU/Mexico Tariff Escalation

President Trump has unveiled a sweeping surge in trade defense, announcing 30% tariffs on European Union and Mexican imports (with Canada already hit at 35%), set to kick in August 1 widening a global trade war that’s threatening supply chains and rattling markets. U.S. futures softened, falling just shy of record highs as investors brace for inflationary ripple effects yet growth stocks remain resilient, pulling back only modestly.

2. China’s Export Rebound Ahead of Deadline

In June, China’s exports surged 5.8% YoY and imports rebounded 1.1%, both beating forecasts, as firms race shipments ahead of an August 12 U.S. tariff truce deadline. Rare earth exports skyrocketed 32% a sign Beijing is securing supply lines in the face of looming U.S. duties.

3. King Charles to Host Trump in September

In a first-of-its-kind move, the U.K. will host a second State Visit from former President Trump in September, with King Charles presiding a symbolic overture that could reset transatlantic trade vibes and diplomatic tones.

Crypto World

🚀 Bitcoin Hits $120K ETFs Are Writing a New Crypto Story

Bitcoin just shattered expectations, touching a new all-time high above $120,000, fueled by relentless ETF inflows and institutional demand. The crypto winter? Officially over.

💸 Key drivers:

Spot Bitcoin ETFs are pouring billions into BTC, creating consistent buy pressure

Retail interest is resurging, but this time it’s paired with structured Wall Street involvement

Global macro uncertainty and fiat devaluation fears are nudging investors toward digital scarcity

🧩 What this rally tells us:

Unlike 2021, today’s Bitcoin breakout is underpinned by legitimacy, not just hype. Institutional desks, sovereign wealth funds, and RIA networks are now allocating not experimenting.

🏦 Broader impact:

Altcoins may follow suit, especially Ethereum and Solana-backed ETFs

Web3 startups may see easier access to capital

Compliance-driven crypto infrastructure (custody, reporting) will become a VC hotbed

The big takeaway? Bitcoin isn’t just a speculative asset anymore. It’s a regulated, institutionally accepted part of the financial system and that changes the rules for everyone.

Welcome to the new crypto normal.

Your Opinion Matters!

Got more feedback or just want to get in touch? Reply to this email and we’ll get back to you.

Thanks for reading.

Until tomorrow!

Hanoomaan Global Markets team

Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy.