Read time: Under 4 minutes

Hello, Market Reader’s

President Trump and Xi Jinping just agreed to resume rare-earth mineral exports to the U.S. a potential lifeline for chipmakers and EV giants. Set for Monday in London, the talks will feature Treasury Secretary Scott Bessent and China’s Vice Premier He Lifeng. Markets are watching closely progress could ease Trump-era tariff tensions, while unresolved issues like tech exports and Taiwan still cast long shadows.

Today’s Global Menu

Focal Point

World Markets

Frontier News

Crypto World

Focal Point

China’s Exports to U.S. Plunge 34.5% Despite Tariff Truce

In a surprising twist following April’s tariff ceasefire, China’s exports to the U.S. nosedived 34.5% in May marking the sharpest drop in over five years, according to new trade data.

While the high-stakes Geneva deal between Washington and Beijing aimed to de-escalate tensions, the damage from April’s tit-for-tat tariffs appears to have left a deeper scar than anticipated. Analysts believe the sharp decline reflects lag effects from disrupted supply chains, canceled orders, and cautious buyers in both economies.

Interestingly, China’s overall export engine didn’t stall. Trade volumes with Southeast Asia and Europe surged, suggesting Beijing is pivoting fast to diversify its trade partners amid geopolitical uncertainty. But the real test will be in June’s data, where analysts expect to see whether the U.S. rebound materializes or if deeper friction persists beneath the surface.

The big question now: Was May’s crash just residual turbulence or a warning sign of longer-term realignment in global trade dynamics?

With U.S. chipmakers, retailers, and logistics firms watching closely, this export freefall may ripple through earnings reports and stock forecasts in the coming weeks.

World Markets

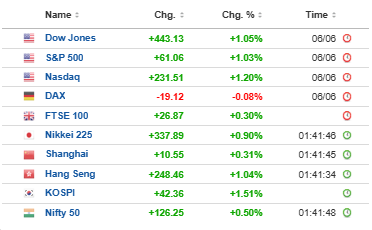

🌏 Trade Optimism Sweeps Asia: Asian equities rallied Monday as anticipation builds over renewed trade talks between Washington and Beijing. Despite weak export numbers and ongoing deflation in China, optimism lit up markets from Tokyo to Hong Kong.

📉 Eyes on Diplomacy: Wall Street futures remained flat, mirroring investor caution ahead of high-stakes U.S.-China trade discussions. With inflation data and rate chatter on the horizon, traders are keeping their powder dry.

🏖️ Volatility Fades: With extreme volatility fading and equities rebounding 20% off spring lows, some experts say it’s time to… unplug. A quiet Fed, range-bound yields, and trade fatigue are creating the perfect backdrop for a summer slowdown.

Learn AI in 5 minutes a day

This is the easiest way for a busy person wanting to learn AI in as little time as possible:

Sign up for The Rundown AI newsletter

They send you 5-minute email updates on the latest AI news and how to use it

You learn how to become 2x more productive by leveraging AI

FRONTIER NEWS

1. Japan’s Growth Stalls as Recession Risk Looms: Japan’s economy just clocked its second straight quarter of contraction, sliding into technical recession territory. Revised GDP data paints a worrying picture, just as PM Ishiba flags that rising rates could tighten the screws on government spending.

2. The $50K Bet That Became $23Mn and Still Rises: What investment turned $50,000 into $23 million in just a decade? It’s not crypto or a lottery ticket it’s a compounding powerhouse that’s still catching analyst eyes. With fundamentals still strong, some say this juggernaut’s story is far from over.

3. Rate Hikes Threaten Japan’s Fiscal Flexibility: With interest rates on the rise, Japan’s PM Ishiba is sounding the alarm: higher borrowing costs could strain the country’s already heavy debt load and force spending cuts.

Crypto World

🛡️ Crypto Security Goes Global: After a wave of brutal crypto kidnappings, the “Bitcoin Family” ditched hardware wallets for a secret system spread across four continents. With metal seed phrases, blockchain encryption, and zero hardware reliance, this is decentralization taken to survivalist levels.

📉 XRP Rebounds: XRP popped 3.8% and futures surged but on-chain activity is telling another story. Active addresses are dropping, and transaction volume is sliding. Without stronger network engagement, this rally might be running on fumes.

🚨 Micro-Cap Madness: KookCapitalLLC just teased a coin with a $450 market cap, sparking frenzy among degens. While the upside potential is sky-high, so is the risk of a brutal dump. With speculation heating up, is this a gem or a grenade?

🤡 BTC Stalls: BTC’s momentum is fading, ETH is throwing mixed signals, and meme-coin “Fartcoin” is proving its name isn’t just a joke. Meanwhile, altcoins are flashing RSI resets and divergence clusters. It's a trader's minefield navigate with care.

Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy.