Read time: Under 4 minutes

Hello, Market Reader’s

President Trump's proposed "revenge tax," embedded in Section 899 of the "One Big Beautiful Bill Act," is stirring global financial waters. This provision could authorize taxation on foreign holdings of U.S. assets, including Treasury bonds, introducing uncertainty that may deter international investors. Such a move risks elevating borrowing costs and could strain the U.S. economy, potentially impacting everything from mortgage rates to credit card interest. As markets grapple with this ambiguity, the stakes for global trade relations and domestic financial stability are mounting.

Today’s Global Menu

Focal Point

Frontier News

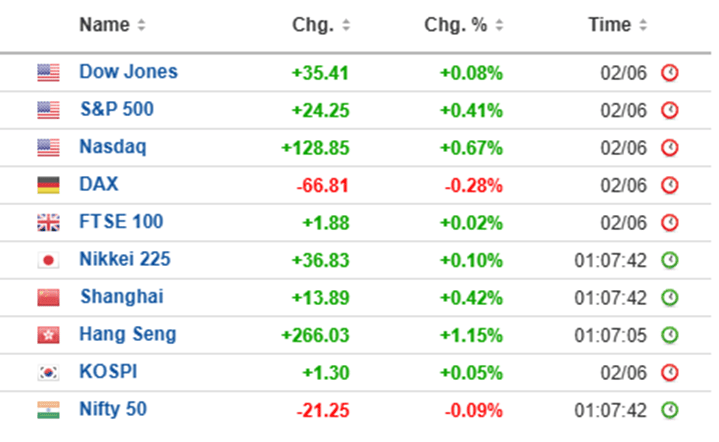

World Markets

Crypto World

Focal Point

Musk’s xAI Bets Big: $5B Debt Sale to Power AI Supercomputer Dreams

Elon Musk is turning up the voltage on his AI ambitions this time with a bold $5 billion debt offering, orchestrated through Morgan Stanley. The capital raise will help fund xAI’s centerpiece: a colossal, state-of-the-art supercomputer slated to power the company’s AI models, including the Grok chatbot. Construction is already underway in Memphis, signaling that Musk isn’t just dreaming big he’s building it.

But that’s not all. In a parallel move, xAI is quietly opening the door to a $300 million employee share sale, seeking a private market valuation of $113 billion. For context, that’s almost twice the valuation of OpenAI’s last reported figure a high-voltage signal that Musk believes his AI brainchild could be the next great disruptor.

What makes this play especially intriguing? xAI is integrating across Musk’s empire. Grok is embedded in X (formerly Twitter), and the company is exploring integrations with Microsoft and Telegram. Think of it as an AI ecosystem brewing inside a social media storm a move that could rewrite the rules of how we interact with intelligent platforms daily.

So, why does it matter?

Debt-backed moonshots like this aren’t just about ambition they test the market’s faith in AI’s future and in Musk himself. Will investors buy into another Musk-powered revolution? Or are we seeing the early signs of tech overreach?

One thing’s clear: the AI arms race just got a fresh injection of fuel and Musk, as always, wants to be in the driver’s seat.

World Markets

⚖️ Shakeup: Alphabet's stock is on shaky ground as analysts warn of a possible 15–25% decline if a U.S. judge mandates the divestiture of Google Chrome. Such a ruling could disrupt Google's advertising stronghold, challenging its integrated ecosystem.

✈️ Turbulence: Airbus reported a 4% year-over-year drop in aircraft deliveries for May, totaling around 51 planes. This dip underscores ongoing challenges in the aerospace sector, including supply chain disruptions and fluctuating demand.

🎶 Remix: Universal, Warner, and Sony are in talks with AI music startups Suno and Udio to establish licensing agreements. The goal is to ensure artists receive compensation when their music is used to train generative AI models.

💸 Buffer: The International Monetary Fund has sanctioned a $1.5 billion, two-year Flexible Credit Line for Costa Rica. Designed as a precautionary measure, this credit line aims to bolster the country's financial defenses against external shocks.

FRONTIER NEWS

1. Asian Markets Lifted by Tech Gains Amid Ongoing Uncertainty

Asian stocks saw a boost on Tuesday, propelled by gains in the technology sector following a positive performance on Wall Street. However, investor sentiment remains cautious due to persistent concerns over U.S.- China trade tensions and soft economic conditions.

2. China's Manufacturing Sector Contracts Sharply in May

China's manufacturing activity experienced an unexpected downturn in May, marking its most significant decline in nearly three years. This contraction, highlighted by the Caixin PMI, underscores the challenges facing the world's second-largest economy, including sluggish demand and ongoing trade disputes.

3. G7 Nations' Soaring Debt Levels Raise Market Concerns

Surging government debt among G7 countries has become a focal point for financial markets, with investors wary of the potential implications for global economic stability. As borrowing costs rise and fiscal policies come under scrutiny, the sustainability of these debt levels is being questioned, potentially leading to increased market volatility and shifts in investment strategies.

4. U.S. Tech Firms Face Challenges in China's Booming AI Market

China's artificial intelligence industry is experiencing rapid growth, driven by substantial investments and a supportive regulatory environment. However, U.S. companies like Nvidia are finding it increasingly difficult to participate in this expansion due to tightening export controls and rising competition from domestic Chinese firms.

Crypto World

🛑 Kurdistan Cracks Down on Crypto After $15M Fraud Case: The Kurdistan Regional Government has launched a sweeping crackdown on crypto activities following a $15 million fraud in Duhok. This hardline stance aims to restore trust and safeguard local investors.

🚀 XRP Surges Amid $100M Treasury Investment and ETF Speculation: XRP experienced a notable uptick as Bitgo and ViviPower announced a $100 million acquisition for treasury purposes. This significant investment has invigorated market sentiment and intensified discussions around a potential XRP ETF

💸 Australia Proposes Tax on Unrealized Crypto Gains: Australia is stirring the pot with a proposed 15% tax on unrealized gains for assets above AUD 3M including crypto. Investors fear this could trigger liquidity issues and change how portfolios are managed.

🌍 Shift in Safe-Haven Assets Euro and Crypto Gain Ground: Amid declining confidence in the U.S. dollar, investors are increasingly turning to the euro and cryptocurrencies as alternative safe-haven assets. This shift reflects a broader reevaluation of traditional financial refuges in response to global economic uncertainties.

Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy.