Read time: Under 4 minutes

Hello, Market Reader’s

In a bold geopolitical move, China is championing the yuan's global status just as confidence in the U.S. dollar flickers. Beijing's play? Push more yuan-based trade settlement deals reshaping the currency chessboard.

Today’s Global Menu

Focal Point

World Markets

Frontier News

Crypto World

Economic Calander

Focal Point

📉 Powell’s Balancing Act Inflation vs. Politics

As inflation whispers threaten to become echoes again, Fed Chair Jerome Powell has reiterated the central bank’s unwavering commitment: price stability comes first even if politics push back. Despite public criticism from former President Trump, Powell stood firm on the Fed’s mandate, emphasizing that any deviation now could lead to a more entrenched inflation problem later.

In an environment where election-year optics can cloud macro decisions, Powell’s stance signals a measured, long-view approach. It’s a reminder to founders, investors, and CFOs alike: don’t anchor your strategy to short-term noise. Inflation, like debt, compounds ignore it too long and it owns the narrative.

🧠 Takeaway: Expect the Fed to hold its course longer than markets may like. Rate-sensitive sectors (real estate, growth tech) need to factor in a “higher for longer” mindset. But for disciplined operators, this could be a window to solidify balance sheets and trim excess.

World Markets

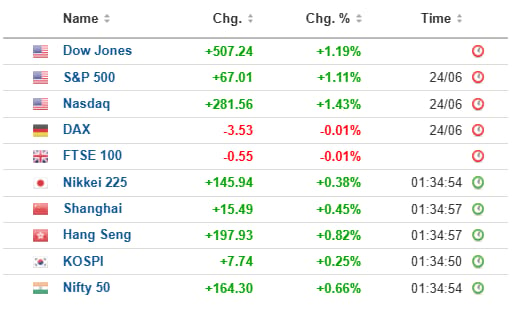

🔥 Sizzling: Markets across Asia lit up as Australia’s inflation showed signs of cooling and the Fed hinted at staying its hand. Investors cheered the combo tame prices and dovish vibes.

🏔️ Avalanche: Wall Street’s bond desks are on high alert. With a deluge of Treasury issuance expected in the second half, yields could climb and liquidity might be tested.

🤔 Breather: Brazil’s rate-setters are tapping the brakes, holding off further hikes for now. But in a candid twist, they warned that the full squeeze from past tightening hasn’t been felt yet.

FRONTIER NEWS

1. Volatile: Crude prices nudged higher with eyes locked on a possible Israel-Iran ceasefire and forecasts of shrinking U.S. stockpiles. It’s a cocktail of geopolitics and supply data just enough to keep traders on edge.

2. Slipping: Tesla’s European sales have hit a speed bump again. A fifth month of declines raises tough questions about its EV dominance amid growing local competition and tightening EU regulations.

3. Gamechanger: Word on the Street? Apple might scoop up Perplexity AI and that’s not just another acquisition rumor. With Siri lagging, this could be Cupertino’s moonshot move into generative search.

Crypto World

💸 Bitcoin Inches Up as Geopolitical Hopes Rise

Bitcoin, Ethereum, and Dogecoin edged higher as investors cautiously welcomed signs of a ceasefire between Iran and Israel, reportedly brokered by Trump. But analysts say the real catalyst lies ahead BTC must close above $108,403 to confirm a sustainable uptrend.

The crypto market is showing its new identity: less speculative casino, more global barometer. As geopolitical tensions impact oil, supply chains, and traditional equities, digital assets are emerging as a 24/7 liquidity hedge and a reflection of investor sentiment.

⚠️ That said, volatility remains the name of the game. The chart may look calm, but the fundamentals are humming with macro risk. With the Fed’s rate path still uncertain and global capital flows shifting, crypto isn’t immune it’s just adapting.

💡For crypto investors: Stay nimble. Watch for technical closes, not just headlines. And understand that Bitcoin is increasingly playing in the big leagues and that means behaving more like a macro asset than a meme trade.

ECONOMIC CALANDER

🗓️ What’s on the Economic Radar Today?

📆 Wednesday’s economic calendar is packed with insights that could move markets particularly in a week shadowed by geopolitical drama and inflation uncertainties.

Here’s what savvy investors and operators are watching:

Durable Goods Orders: A leading indicator of manufacturing strength. Flat or weak numbers here may signal corporate hesitancy amid Fed policy uncertainty.

Pending Home Sales: Important for real estate-linked equities and mortgage rate sensitivity. With affordability at a crunch point, this data could be a real sentiment driver.

Crude Oil Inventories: Especially relevant now, given Middle East tensions. Supply shocks or drawdowns can ripple through energy stocks and inflation expectations.

Fed Speak: Any remarks that hint at policy rigidity or flexibility will be dissected in real-time.

🎯 Why it matters: Macros aren’t just noise they shape capital flows, startup runway strategies, and even product launches (yes, inflation touches SaaS too).

Pro tip: Have a 5-minute dashboard check-in every economic release day. It’s the cheapest risk management you can do.

Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy.