Read time: Under 4 minutes

Hello, Market Reader’s

President Trump is gearing up to unleash sweeping blanket tariffs, shrugging off fresh inflation worries like yesterday’s news. Investors are bracing for ripple effects that could upend global trade flows and stoke price pressures just as markets crave stability.

Today’s Global Menu

Focal Point

World Markets

Frontier News

Crypto World

Focal Point

Tariffs on Canada: A New Trade Tension or Old Playbook?

When tariffs go up, so do costs and businesses pay the real price first.

President Trump just fired a fresh shot in North America’s trade landscape announcing 35% tariffs on a range of Canadian imports starting August 1.

While the political spin is about “protecting American jobs and industry,” the reality for businesses is more complicated. From lumber and steel to car parts and food products, these tariffs hit sectors deeply woven into cross-border supply chains that have evolved over decades.

✅ What founders, operators, and supply chain leaders should watch:

1️⃣ Cost pass-throughs aren’t optional. Many US manufacturers and builders rely on Canadian inputs. Higher costs upstream mean tighter margins or higher prices for consumers.

2️⃣ North America’s competitive edge. Integrated trade under USMCA helped North American businesses stand up to global rivals. Tariffs risk fracturing that edge again.

3️⃣ Uncertainty kills agility. Just when businesses crave stability to plan capex, hiring, or exports, tariff threats throw planning out the window.

💡 Tariffs rarely stay political theory they land in boardrooms, small business P&Ls, and household budgets.

💬 Are tariffs a necessary defense or an avoidable cost? If you rely on US–Canada supply lines, how are you hedging for August 1? Drop your strategies let’s share what’s working.

World Markets

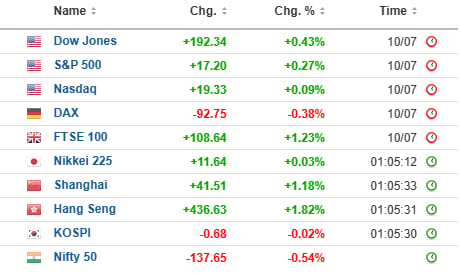

Crossroads: Asian shares wavered overnight as Wall Street’s latest record run left investors torn between optimism and caution. Tech-heavy indexes tried to ride the momentum, but jitters over global growth kept gains in check.

Rocket: Wall Street’s tech juggernaut is roaring again, propelling the S&P 500 to yet another record as chipmakers and AI giants surge. Investors are betting big on innovation, brushing aside recession chatter for now.

FRONTIER NEWS

1. Catalyst: Google is reportedly offering steep discounts on its cloud computing services to the U.S. government a strategic play that could tighten its grip on lucrative federal contracts. This aggressive pricing move sets up a showdown with rivals like Amazon and Microsoft in the race to dominate Washington’s digital backbone.

2. Pulse: In a major pivot, Shanghai’s top regulator is weighing relaxed IPO rules to revive China’s slowing equity market. The proposed shift could open the floodgates for tech unicorns craving fresh capital, injecting new life into Asia’s biggest financial hub.

3. Blueprint: As Wall Street pushes deeper into record territory, all eyes are on Apple’s next move and looming big bank earnings. Traders are crafting fresh strategies to ride this bullish wave balancing tech’s relentless momentum with banks’ earnings surprises.

4. Surge: India’s Glenmark Pharma just hit an all-time high after sealing a blockbuster cancer drug deal with AbbVie. This groundbreaking partnership spotlights India’s rising clout in cutting-edge biotech, sending investors scrambling for a piece of the action.

Crypto World

I. Zenith: The world’s largest cryptocurrency just shattered another record high, reigniting a frenzy across digital markets. With fresh institutional money pouring in and retail traders chasing the wave, crypto’s wild ride shows no signs of slowing down.

II. Fusion: Perplexity AI just joined forces with Coinbase in a groundbreaking bid to supercharge crypto intelligence tools. By blending cutting-edge AI with blockchain insights, this partnership promises sharper market predictions for traders and institutions alike.

Your Opinion Matters!

Got more feedback or just want to get in touch? Reply to this email and we’ll get back to you.

Thanks for reading.

Until tomorrow!

Hanoomaan Global Markets team

Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy.