Read time: Under 4 minutes

Hello, Market Reader’s

Global investors have quietly shifted gears pouring a hefty $13.6 billion into non-U.S. equity funds in July, the biggest inflow in over four years. Meanwhile, U.S.-focused funds shed $6.3 billion, as concerns brew over pricey valuations, a weakening dollar, and uncertain U.S. fiscal policy. It feels like smart money is circling toward Europe and emerging markets.

Today’s Global Menu

Focal Point

World Markets

Frontier News

Crypto World

FOCAL POINT

Markets Rally as 🇺🇸U.S.-China🇨🇳 Extend Tariff Ceasefire

In a move that’s given global markets a collective sigh of relief, the U.S. and China have agreed to extend their tariff truce for another 90 days, pushing the deadline to November 10, 2025. The extension averts a scheduled spike in duties that would have hit billions of dollars’ worth of goods from consumer electronics to agricultural products right before the holiday season.

For U.S. retailers and manufacturers, this is a crucial lifeline. Avoiding higher import costs keeps shelves stocked and prices steadier, while global supply chains, already under pressure from shipping delays and geopolitical friction, get a temporary reprieve.

Markets reacted instantly: oil prices ticked up on improved trade sentiment, and equities across Asia and Europe posted gains. There’s even talk of a potential Trump–Xi summit to solidify a broader agreement.

But make no mistake this is a pause, not a peace treaty. Sticking points remain on sensitive issues like rare-earth mineral access, AI chip exports, and intellectual property protections. Both sides are holding their cards close, and the next three months could determine whether we see a breakthrough or another flare-up in the world’s most influential trade relationship.

2025: The Year of the One-Card Wallet

When an entire team of financial analysts and credit card experts go to bat for the credit card they actually use, you should listen.

This card recommended by Motley Fool Money offers:

0% intro APR on purchases and balance transfers until nearly 2027

Up to 5% cash back at places you actually shop

A lucrative sign-up bonus

All for no annual fee. Don't wait to get the card Motley Fool Money (and everyone else) can't stop talking about.

WORLD MARKETS

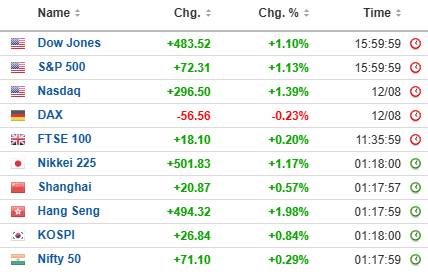

🌏 Surge: Asian markets caught a tailwind today after softer-than-expected U.S. inflation data, which stoked rate-cut hopes from the Federal Reserve. Japan’s Nikkei raced past 43,000 for the first time ever while global equities like the MSCI All Country World Index also hit fresh highs.

📈 Peaking? The S&P 500 closed above 6,400 for the first time on August 12, powered by tame inflation and optimism around upcoming Fed easing. Yet, the triumph feels tempered tariff pressures could soon erode consumer spending and squeeze margins.

FRONTIER NEWS

🚨 Red Alert: Despite a $21 billion tariff revenue surge, July’s U.S. budget deficit ballooned to $291 billion, marking a 19% year-over-year jump. Strong customs duties couldn’t offset record-high spending in healthcare, Social Security, and debt interest triggering fiscal alarm bells.

⛽ Drift: Oil prices are hovering near two-month lows, as markets digest an unexpected 1.5 million-barrel build in U.S. inventories and eye a looming Trump‑Putin summit. With demand signals weakening and geopolitics in play, traders are treading cautiously.

📉 Pivot: President Trump is ramping up pressure on the Fed to cut rates, and Treasury Secretary Scott Bessent didn’t hold back hinting at a bold 50 basis point cut as a possible September move.

🛑 Blockade:Nvidia’s re-entry into China hit a snag: despite a deal allowing chip exports with a 15% revenue tax—Beijing is now urging companies to avoid Nvidia’s H20 AI chips, especially in sensitive sectors.

CRYPTO WORLD

Crypto Momentum: Litecoin Leads the Charge as Market Sentiment Warms

The crypto market woke up with a jolt today, as Litecoin (LTC) stole the spotlight with a climb to $130.67, marking a 6.4% jump in trading volume. This surge, while modest compared to past bull runs, signals a renewed appetite among investors for altcoins with established track records.

Bitcoin (BTC) and Ethereum (ETH) followed suit with steady upward moves, helping stabilize overall market sentiment. While Bitcoin remains the industry’s north star, Litecoin’s strong daily performance hints that investors might be diversifying into assets they see as undervalued or poised for near-term catalysts.

Memecoins like Dogecoin (DOGE) and altcoin favorites such as Solana (SOL) and XRP are also seeing light gains, suggesting a broader ripple effect across the market. This kind of synchronized uptick often sparks speculation: Is this the start of a longer rally, or just a mid-summer bounce?

The next few days will be telling. If trading volumes hold and Bitcoin breaks above key resistance levels, altcoins could ride a stronger wave of momentum. For now, it’s a cautious but welcome breath of optimism in what has been a choppy crypto season—reminding traders that in this market, sentiment can shift in a heartbeat.

The Smart Way to Deploy Secure Voice AI

Learn how security unlocks Voice AI for enterprise teams. This guide covers HIPAA, GDPR, and SOC 2 readiness—plus how to deploy agents across 100+ locations without slowing down procurement or risking compliance.

Your Opinion Matters!

Got more feedback or just want to get in touch? Reply to this email and we’ll get back to you.

Thanks for reading.

Until tomorrow!

Hanoomaan Global Markets team

Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy.