Read time: Under 4 minutes

Hello, Market Reader’s

India’s Commerce Minister Piyush Goyal has said negotiations with the U.S. are making “fantastic” progress sparking hopes for preferential tariffs for India compared to peers like Japan and Vietnam, since it entered talks early. With the August 1 deadline for Trump’s “reciprocal” tariff pause fast approaching, Goyal expressed confidence that India will receive special treatment, potentially securing lower duties than competitors. Though agriculture and dairy remain sticking points, he hinted that sectoral deals could still emerge even if a full agreement proves elusive emphasizing India's willingness to explore balanced, win‑win outcomes.

Today’s Global Menu

Focal Point

World Markets

Frontier News

Crypto World

FOCAL POINT

🇺🇸 Trump vs. Powell: A Monetary Tug-of-War Begins Again?

In an unexpected twist, President Donald Trump visited the Federal Reserve and openly clashed with Chair Jerome Powell over current economic policy - particularly interest rates.

📉 Trump made it clear: he’d “love lower interest rates,” criticizing the Fed for being too slow to act.

Meanwhile, Powell remains focused on containing inflation and protecting the Fed’s independence. The visit, while symbolic, sent a loud message - especially with elections approaching.

💡 Why this matters:

A renewed political spotlight on the Fed could impact how markets interpret future policy moves.

Lower rates may boost consumer sentiment and markets short term, but inflation risk still looms.

The Fed is now walking an even thinner line - between market expectations and political pressure.

For investors and business leaders, this is a reminder of how intertwined monetary policy and politics can be. As rates dictate borrowing costs, consumer demand, and stock valuations, expect volatility as rhetoric heats up.

The 2025 race isn’t just electoral. It’s economic too.

WORLD MARKETS

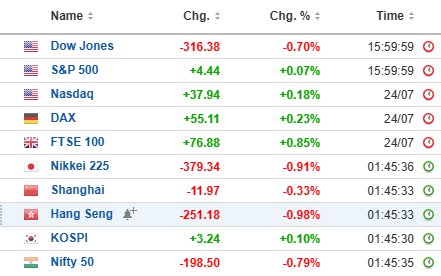

🌍 Retreat: Following record-breaking Wall Street gains powered by strong Alphabet and AI stock performance, Asian markets slipped Nikkei - 0.7%, Hang Seng -1.1%, Shanghai Composite -0.3%, ASX -0.4%. Meanwhile, Kospi bucked the trend with a +0.3% uptick, and India and Taiwan edged down slightly. Inflation cooling in Tokyo to 2.9% and US-China trade jitters added to the cautious tone.

📈 Surge: Asian equities climbed on July 24 as corporate earnings impress and fresh US trade deals boost investor morale - Japan’s Topix hit an all‑time high, while the Aussie dollar surged to an eight‑month peak. Alphabet’s strong cloud and AI outlook kicked off a rally in tech shares, reinforcing optimism around the “Magnificent Seven.” Regional sentiment increasingly upbeat despite some tariff concerns.

📉 Slump: India markets braced for a downturn as Sensex fell ~200–542 points, dragging Nifty below 25,100–25,200. Pressure came from underwhelming IT earnings and profit‑booking in banking stocks, alongside renewed uncertainty over U.S. trade policy and Trump’s Fed involvement. Foreign investors remained cautious, though hopes for a UK‑India trade deal remain in the mix.

FRONTIER NEWS

🚨 Glitch: Elon Musk’s Starlink went offline in a rare global hiccup, disrupting service for tens of thousands from the U.S. to Europe. A network software bug was the culprit-now patched-but the brief blackout raises big questions about the reliability of satellite internet as digital lifelines expand.

📈 Resurgence: In a surprising twist, Europe’s overlooked small-cap stocks are stealing the spotlight as growth and rate cuts stir investor excitement. With inflation easing and industrial recovery in sight, funds are flowing into niche manufacturers and agile tech firms.

🧨 Monopoly: Trump said he mulled breaking up Nvidia over AI dominance until realizing just how tough untangling such a giant would be. After chats with Jensen Huang and advisors, he backed off, underscoring how deeply Nvidia’s tech tentacles reach. The idea may be shelved, but the warning shot has been fired.

🛠️ Shakeup: Intel’s Q2 revenue beat forecasts at $12.9B, but a $2.9B loss loomed large fueled by layoffs, facility cuts, and strategic shifts. It’s part of a painful pivot toward AI and foundry realignment.

CRYPTO WORLD

💥 Bloodbath for Crypto Longs: Bitcoin Crashes Below $116K

It’s been a brutal 24 hours for crypto bulls.

Bitcoin tumbled below $116,000, triggering a cascade of long liquidations and wiping out millions in leveraged positions. It’s a stark reminder that even in a bullish cycle, corrections can be ruthless.

📉 Key stats:

$220M in long positions liquidated within hours.

Sudden drop attributed to macro uncertainty and possible whale moves.

Altcoins followed suit, with some plunging 10–15% overnight.

But let’s zoom out.

This is crypto’s nature: volatile, fast-moving, sentiment-driven. For long-term holders, such drops are tests of conviction. For traders, they’re opportunities - but only with proper risk management.

🧠 Lessons:

Don’t over-leverage in uncertain macro conditions.

Use stop-losses. Always.

Volatility = opportunity only when paired with discipline.

As institutions enter and market maturity grows, drawdowns like these may become less extreme - but they’re not gone yet.

Crypto winter isn’t here - but a cold breeze just blew through.

Your Opinion Matters!

Got more feedback or just want to get in touch? Reply to this email and we’ll get back to you.

Thanks for reading.

Until tomorrow!

Hanoomaan Global Markets team

Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy.